In the life cycle of a business, there is no moment quite as pivotal as CEO succession. This is a huge moment, an opportunity to continue the company's upward trajectory and to bring new skills to the company. Get it right, and the results can be transformational. But, get it wrong, and your company can lose serious momentum. This is especially true for employee owned companies (ESOPs). Employee owners are strong team players and are more heavily invested in the company, and they expect transparency, approachability and communication in return. The wrong CEO can have a devastating impact on the health of your company and the engagement of your employee owners.

As retained executive search partners in Minneapolis, KeyStone has led ESOPs nationwide through these business-defining moments. Here are some of the most common questions we hear from employee owned companies preparing for their CEO's succession.

1. When do I start?

You can't start to early when planning for CEO succession. The ideal time frame is 2-5 years out, but if you are already less than 2 years away - get started ASAP.

2. What should I consider first?

The first step is to establish a timeline for your succession plan. Start with an end date and work backwards. Even though this end date may change slightly, having a date to work toward is key. From here you can start to fill in what needs to happen between now and that end date.

3. Our current CEO has been extremely successful - should we look for someone similar?

In some ways, yes. But in other ways, no. Under you CEO's leadership, the company has likely grown and evolved and the market has changed. Therefore, the profile of the CEO you need is different than the profile of the CEO you have.

The profile (job description) should be built upon your company's strategic plan. Are you planning to grow exponentially? Are you planning to enter new markets? Are you working toward becoming more operationally efficient? Questions derived from your strategic plan will help determine your profile.

Assuming this CEO has been successful and is well-respected, the core values and cultural profile will be similar or identical to the outgoing CEO.

Client Example

Nearly 8 years ago, an ESOP manufacturing company engaged KeyStone Search to assist the Board of Directors in hiring a new CEO. This CEO was well-respected and had been with the company for over 25 years, including 12 as CEO. In the history of the company there had only been 2 CEOs and both came up through sales and engineering. Because the growth plan of the company was heavily weighted on profitability improvement and potential acquisitions, it was determined the next CEO should have a strong financial background. The CEO who was ultimately hired was an individual who came up through finance, was a CFO and then President of another company. Since the new CEO took over, the company has grown nearly threefold, as has the ESOP value. Of course, this was not solely due to his financial background, but it helped to accelerate the growth trajectory.

4. How should the Board of Directors be involved?

CEO succession is a board-driven process. There is no greater responsibility of the board than to ensure the right person is in the CEO chair. In this process, KeyStone has seen that a combination of both outside and inside board members is especially effective. Outsiders bring objectivity and a view of the broader business environment and the insiders ensure the core values and culture are maintained.

If your company does not have a board, or your board does not include outside directors, a looming CEO succession may be the reason to start building or reorganizing your board.

5. How should our company involve our employee owners?

Communication is key. When a CEO nears retirement, employee owners are justifiably uncertain about the future of the company. When the CEO profile and timeline are identified, communicating openly and appropriately can help settle this uncertainty. Often, boards or CEOs are afraid to share information early, not wanting to cause undue alarm. However, we have found that being open with employee owners as early as possible (once a plan is in place) is the best policy. Knowing the company has a detailed plan in place eases uncertainty.

6. What about potential internal successors?

Having an internal candidate who is truly capable and prepared is always the best choice. However, because companies change quickly (and markets change even more quickly) having an internal leader ready is not always a possibility. The Board of Directors must objectively evaluate internal candidates against the strategic plan of the business to ensure the best interests of all employee owners.

7. What should our search process look like?

Assuming you are considering outside candidates, it is critically important that you source enough qualified candidates for the role. If you don't put enough quality candidates into your process, it is likely you could settle for a less than outstanding candidate. This is one way a reputable retained search firm can assist - finding qualified candidates you cannot reach via your internal resources.

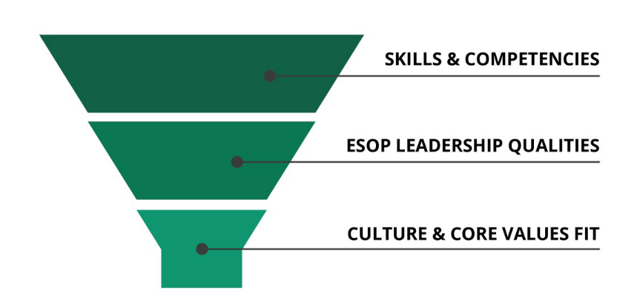

When you've added enough (at least 6) highly qualified candidates to the mix, the interviewing process begins. At KeyStone, we have developed a framework for evaluating CEOs and other leaders for ESOPs. This framework includes 3 tiers of evaluation.

8. We hired a great CEO - now what?

8. We hired a great CEO - now what?

The process does not end when your new CEO takes the job. It is critical to create an onboarding and go forward plan to maximize efforts and create early momentum. This plan should be detailed around specific activities in the first 30, 60, 90 days and should include a first-year action and results plan monitored by the Board of Directors.